General Corporate Compliance Training

General Corporate Compliance

Compliance training solutions for banking and financial professionals

Our General Corporate Compliance training is a suite of engaging modules designed to meet regulatory compliance and conduct requirements.

Meet your organisation’s risk and compliance obligations with relevant and meaningful learning. (RG 104 AFS licensing: Meeting the general obligations, RG 205 Credit licensing: General conduct obligations).

Who is our general corporate compliance training for?

- Licensees must comply with general obligations under various Acts, including the Corporations Act.

- All financial representatives must be trained to adhere to financial services-specific regulation and industry codes with respect to conduct.

Licensees are also required to be able to provide evidence to regulators that their representatives are adequately trained to perform their role on both an initial and ongoing basis.

A simple enterprise-wide solution for a complex world of regulation.

We understand that effective compliance training is not just about delivering regulatory content—it’s about creating learning that is engaging, relevant and impactful for organisations and their employees. We are committed to designing training experiences that resonate with individuals, ensuring they gain practical knowledge and skills that are immediately applicable to their roles.

Our Corporate Compliance modules are suitable for organisation wide training from front-line employees to management and leadership and directors.

Highly contextualised to financial services

Australian specific financial services content further contextualised by supervising regulator (ASIC/APRA) or industry sector.

Effective, impactful training

Our modules are approximately 30 minutes duration. This is an ideal study time that is not only convenient, but also ensures learners can process and retain important information and apply it effectively in their roles.

Know your learning is current and accurate

Modules reviewed by leading compliance consultants and legal council. Instructionally designed. Quizzes and activities to support knowledge.

Flexible training delivery | Customisable

Customisation points to reference their own processes, policies and scenarios. Host your general compliance training on your system or ours.

Frequently Asked Questions

Corporate Solutions

Request a quote for your team.

OR

Purchase online: Three easy steps to get your team started.

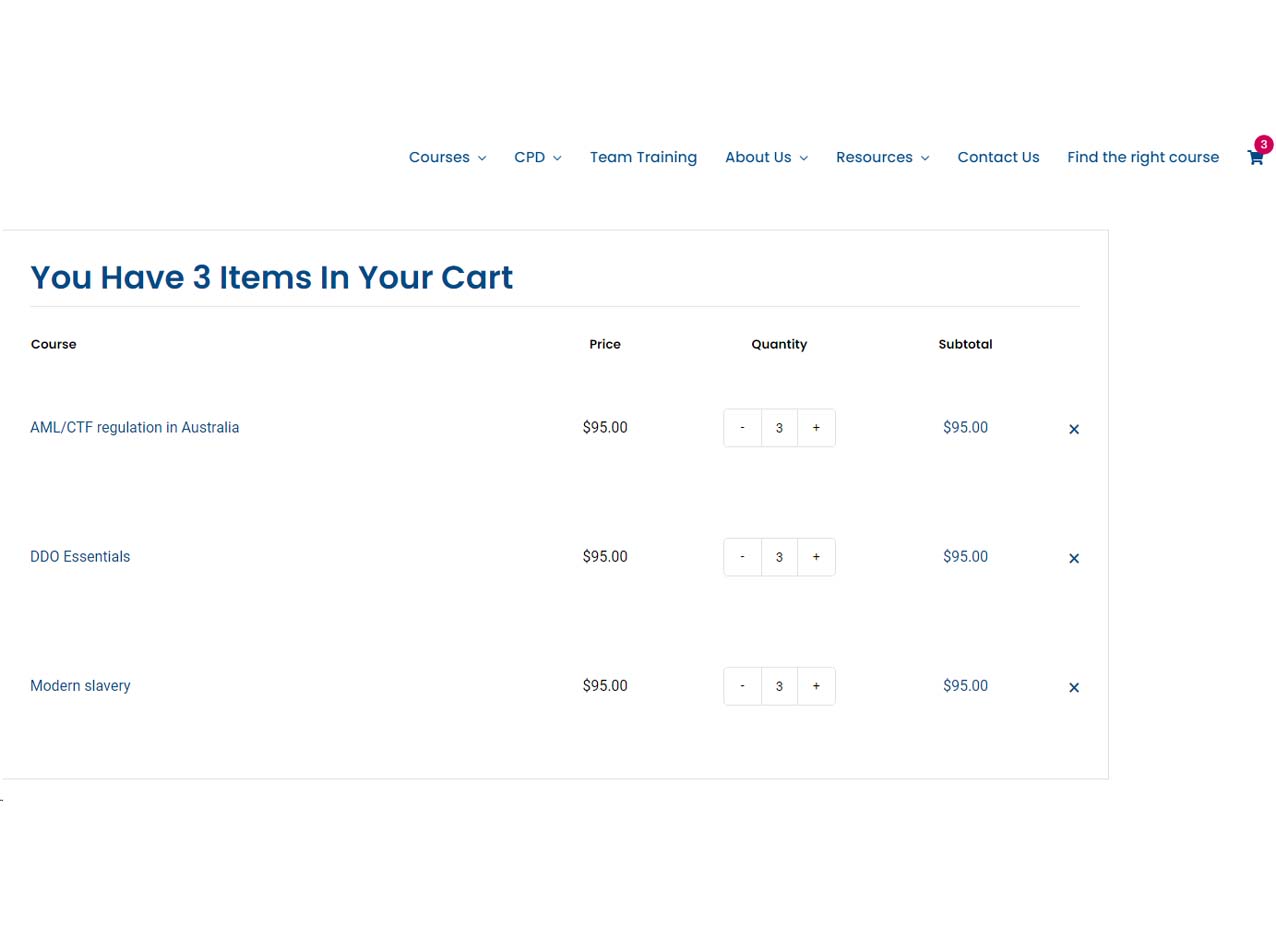

- Visit our Shop Page and select General Compliance

- Select your courses to meet you and your team’s general obligations

- Add the required number of courses to your cart

We will request participants name and email. Once confirmed, we will enrol your team and they can begin their training.

Our general corporate compliance training contains a suite of engaging online modules designed to make employees aware of their responsibilities and feel empowered to uphold the conduct and regulatory standards applicable to their organisation.

A general compliance module – refers to a corporate e-learning course designed to meet specified organisational, legislative and/or conduct requirements.

The team at FEP understands that effective compliance training is not just about delivering regulatory content; it’s about creating learning that is engaging, relevant and impactful for organisations and their employees.

We design training experiences that resonate with individuals, ensuring they gain practical knowledge and skills that are immediately applicable to their roles.

Regulatory News

-

12 July 2024

ASIC and APRA issue final rules and information for the Financial Accountability Regime

12 July 2024The Australian Securities and Investments Commission and the Australian Prudential Regulation Authority have published new information to help insurers and superannuation trustees prepare for the commencement of the Financial Accountability Regime.

The FAR already applies to the banking industry, and takes effect for the insurance and superannuation industries from 15 March 2025. It imposes a strengthened responsibility and accountability framework to improve the risk governance cultures of APRA-regulated entities, their directors and most senior executives.

View ASIC WebsiteASIC and APRA issue final rules and information for the Financial Accountability Regime

The Australian Securities and Investments Commission and the Australian Prudential... -

10 July 2024

ASIC successful in first DDO case against Firstmac

10 July 2024The Federal Court found that Firstmac Limited breached the new design and distribution provisions by failing to take reasonable steps that would have resulted in, or would have been reasonably likely to have resulted in, the distribution of one of its investment products being consistent with its target market determination for the product. This is the first finding by a court of a contravention of these provisions.

The Court found Firstmac implemented a ‘cross-selling strategy’ of marketing investments in its High Livez investment product to 780 consumers who held existing term deposits with Firstmac. In doing so, it breached its design and distribution obligations (DDO) when it sent product disclosure statements (PDS) for the Firstmac High Livez product to those existing term deposit holders, without first taking reasonable steps to ensure consistency with its TMD for the product. The conduct occurred between from October 2021 to September 2022.

ASIC Deputy Chair Sarah Court said ‘ASIC took this case because we were concerned that customers were exposed to the risk they might obtain a financial product that was not appropriate to their needs and objectives. This should act as a deterrent to anyone engaged in cross-selling financial products who fails to consider their design and distribution obligations before sending product disclosure statements,’ Ms Court said.

View ASIC WebsiteASIC successful in first DDO case against Firstmac

The Federal Court found that Firstmac Limited breached the new... -

5 July 2024

Court declares PayPal Australia used an unfair contract term

5 July 2024The Federal Court has declared a term used by PayPal Australia Pty Limited (PayPal) in its standard form contracts with small businesses to be unfair.

The Court found that the term was unfair because its effect was to allow PayPal to retain fees that it had erroneously charged if the small business failed to notify PayPal of the error within 60 days of the fee appearing on its account statement.

The declarations affect small businesses who opened a PayPal Business Account between 21 September 2021 to 7 November 2023. As of 30 June 2023, there were over 600,000 small businesses with PayPal Business Accounts. PayPal agreed that the term was unfair and consented to the declarations, having voluntarily removed the term from its contracts on 8 November 2023.Deputy Chair Sarah Court said, ‘ASIC is dedicated to protecting consumers and small businesses from unfair contract terms and ensuring that all financial services providers use fair contract terms.’

‘Today’s decision serves as a reminder to all businesses that unfair contract terms contained within standard form contracts with small businesses will not be tolerated, and that ASIC will take decisive action where appropriate to protect the rights of consumers and small businesses.’

View ASIC WebsiteCourt declares PayPal Australia used an unfair contract term

The Federal Court has declared a term used by PayPal... -

4 July 2024

APRA strengthens core prudential standard to support outcomes for members in super

4 July 2024The Australian Prudential Regulation Authority (APRA) has enhanced a core prudential standard governing strategic planning and member outcomes in superannuation.

The updated Prudential Standard SPS 515 Strategic Planning and Member Outcomes (SPS 515) and related guidance reinforce trustees’ duty to act in the best financial interests of members. The changes ensure members’ interests are front-and-centre in trustees’ strategic and business planning, financial resource management, implementation of the retirement income covenant and fund transfers.

Deputy Chair Margaret Cole said: “By strengthening this core strategic planning standard, APRA is setting a clear expectation for trustees to put members front of mind in every decision they make and the way they run their businesses every day.”

View APRA WebsiteAPRA strengthens core prudential standard to support outcomes for members in super

The Australian Prudential Regulation Authority (APRA) has enhanced a core... -

27 June 2024

Speech by ASIC Chair Joe Longo at the Australian Banking Association Conference, 27 June 2024.

27 June 2024Putting customers at the centre of banking

Speech by ASIC Chair Joe Longo at the Australian Banking Association (ABA) Conference, 27 June 2024.

KEY POINTS

- Banks have a serious impact on the lives of Australians. When the customer is at the heart of their operations, that impact is for the good.

- Following consultation, ASIC has approved the new February 2025 Banking Code of Practice. As self-regulatory initiatives, industry codes have the potential to deliver real benefits to consumers, small businesses and subscribing entities.

- ASIC will continue to remain focused on the need for enhanced consumer protections, including in relation to proactively identifying customers eligible for basic bank accounts, the proactive identification of consumer vulnerability, and protections for loan guarantors.

Speech by ASIC Chair Joe Longo at the Australian Banking Association Conference, 27 June 2024.

Putting customers at the centre of banking Speech by ASIC... -

27 June 2024

ASIC approves enhanced Banking Code of Practice

27 June 2024ASIC has approved a new version of the Australian Banking Association’s (ABA) Banking Code of Practice, which includes enhancements to key protections. The new Code will commence on 28 February 2025.

View ASIC WebsiteASIC approves enhanced Banking Code of Practice

ASIC has approved a new version of the Australian Banking... -

26 June 2024

APRA publishes Chair John Lonsdale’s speech to Australian Banking Association Conference

26 June 2024The Australian Prudential Regulation Authority (APRA) has published a speech delivered by Chair John Lonsdale to the Australian Banking Association Conference in Melbourne.

In “A view from the other side”, Mr Lonsdale spoke about the importance of a strong, stable and resilient banking system to protect the community and taxpayers, as well as supporting a thriving economy.

View APRA WebsiteAPRA publishes Chair John Lonsdale’s speech to Australian Banking Association Conference

The Australian Prudential Regulation Authority (APRA) has published a speech... -

26 June 2024

ASIC calls on market intermediaries to strengthen supervision of business communications

26 June 2024ASIC is calling on market intermediaries to strengthen their supervisory arrangements for recording and monitoring representatives’ business communications to prevent, detect and promptly address misconduct and contraventions of financial services laws.

View ASIC WebsiteASIC calls on market intermediaries to strengthen supervision of business communications

ASIC is calling on market intermediaries to strengthen their supervisory... -

19 June 2024

APRA releases letter on SPS 530 Valuation Governance Framework Self-Assessment Survey

19 June 2024The Australian Prudential Regulation Authority (APRA) has released a letter to RSE licensees outlining key observations from the SPS 530 Valuation Governance Framework Self-Assessment Survey.

The survey of unlisted asset governance practices was conducted by APRA in late 2023 to assess the implementation of the enhanced requirements contained in Prudential Standard SPS 530 Investment Governance and related guidance.

View APRA WebsiteAPRA releases letter on SPS 530 Valuation Governance Framework Self-Assessment Survey

The Australian Prudential Regulation Authority (APRA) has released a letter... -

3 June 2024

APRA clarifies expectations on cyber security and adequacy of backups

3 June 2024The Australian Prudential Regulation Authority (APRA) has written to all APRA-regulated entities emphasising the critical role of data backups in cyber resilience. This communication is part of APRA’s ongoing commitment to supervising cyber resilience across industry, as outlined in its Interim Policy and Supervision Priorities update.

The letter details the common issues observed in backup practices that could hinder system restoration during an incident. APRA expects regulated entities to review their backup arrangements and address any identified gaps promptly.

View APRA WebsiteAPRA clarifies expectations on cyber security and adequacy of backups

The Australian Prudential Regulation Authority (APRA) has written to all... -

30 May 2024

Three principles for better compliance

30 May 2024ASIC Commissioner Simone Constant addressed investor relations professionals at the 2024 Australasian Investor Relations Association (AIRA) Annual Conference regarding compliance with regulatory changes affecting listed entities.

‘It comes down to three really important but simple principles – transparency, accountability and consistency in meeting the fair expectations of your stakeholders,’ Commissioner Constant said.

View ASIC WebsiteThree principles for better compliance

ASIC Commissioner Simone Constant addressed investor relations professionals at the... -

21 May 2024

Select Committee on Adopting Artificial Intelligence

21 May 2024Opening Statement by ASIC Chair Joe Longo at the inquiry into the opportunities and impacts for Australia arising out of the uptake of AI technologies in Australia.

I am pleased to appear before the Committee today and to provide this short opening statement.

My name is Joseph Longo and I am the Chair of ASIC.

I am joined by Executive Director of Markets, Calissa Aldridge and our Digital and Legal Transformation Lead, Graham Jefferson.

ASIC is supportive of the safe and responsible use of AI by Australian businesses.

We believe that effective AI tools may bring enormous benefits to businesses and end-users. On the other hand, irresponsible or malicious use of AI tools may cause considerable harm to consumers.

This is why we are extremely interested in the use and impact of AI technologies in the financial system, so much so that we have made it a key priority for ASIC.

View ASIC WebsiteSelect Committee on Adopting Artificial Intelligence

Opening Statement by ASIC Chair Joe Longo at the inquiry... -

20 May 2024

ASIC report: Australians need better hardship support from their lenders

20 May 2024The report, Hardship, hard to get help: Lenders fall short in financial hardship support (REP 783) outlines findings from ASIC’s review of 10 large home lenders. The review found they should be doing more to support Australians who were struggling to meet their repayments.

The report highlights failures of lenders to identify customers in financial stress, use of ‘cookie-cutter’ approaches to dealing with hardship requests, as well as onerous assessment and approval processes.

ASIC is also concerned lenders have inadequate arrangements for supporting vulnerable Australians including those experiencing family violence.

ASIC Commissioner Alan Kirkland, whose remit includes support for vulnerable consumers, said lenders were not “putting customers front and centre” in their approach to financial hardship.

“Many lenders aren’t taking their customers’ unique situations into account, instead providing a standardised ‘one-size-fits all approach’, which is not meeting customers’ needs,” Commissioner Kirkland said.

View ASIC WebsiteASIC report: Australians need better hardship support from their lenders

The report, Hardship, hard to get help: Lenders fall short in... -

15 May 2024

ASIC announces 30 June 2024 focus areas and expanded program to support financial reporting and audit quality

15 May 2024ASIC has outlined an expanded program of work to enhance the integrity and quality of financial reporting and auditing in Australia in achieving the broader goal of confident and informed investors.

This included ASIC’s focus areas for 30 June 2024.

ASIC continues to encourage voluntary climate reporting and urge directors and assurance

View ASIC WebsiteASIC has outlined an expanded program of work to enhance... -

2 May 2024

Second stage consultation on reforming Australia’s AML/CTF regime is now open

2 May 2024On 2 May the Attorney-General announced the second stage consultation on reforming Australia’s anti-money laundering and counter-terrorism financing (AML/CTF) regime. This stage includes the Attorney-General’s Department (the Department) releasing consultation papers, which outline a series of detailed proposals for reforming the AML/CTF regime. These papers were developed following feedback from the first round of consultation, which ran from April to June 2023.

The Australian Government is committed to protecting Australians and preventing criminal abuse of our financial system. This includes efforts to ensure Australia’s AML/CTF regime continues to effectively deter, detect and disrupt money laundering and terrorism financing, responds to the constantly evolving threat environment and meets international standards.

View sourceSecond stage consultation on reforming Australia’s AML/CTF regime is now open

On 2 May the Attorney-General announced the second stage consultation... -

1 May 2024

APRA publishes remarks by its Executive Board Member, Suzanne Smith, delivered at the All Actuaries Summit

1 May 2024The Australian Prudential Regulation Authority (APRA) has published remarks by Member Suzanne Smith to the All Actuaries Summit on the Gold Coast.

In “Think Bigger: The Power of a Thriving Insurance Industry”, Suzanne highlighted how a flourishing insurance landscape supports the wellbeing of our society, as well as examining how to address current challenges and sustainability concerns in the life insurance sector.

View APRA WebsiteThe Australian Prudential Regulation Authority (APRA) has published remarks by... -

26 April 2024

APRA and ASIC release notes on Superannuation CEO Roundtables

26 April 2024APRA and ASIC held Superannuation CEO Roundtables on Wednesday, 27 March and Thursday, 28 March 2024. The theme of these discussions was resilient and member-focused fund operations.

Hosted by Simone Constant, Commissioner, ASIC and Carmen Beverley-Smith, Executive Director, APRA, the Roundtables were attended by 20 superannuation chief executive officers (CEOs) and other executives, representing a broad cross-section of the industry across two separate roundtables.

The work on operational resilience is foundational and necessary for supporting robust fund operations, and both agencies encouraged trustees to maintain a strong focus on the interactions members have with their funds in undertaking this work. Regulatory changes under the Financial Accountability Regime (FAR) and Prudential Standard CPS 230 Operational Risk Management (CPS 230), in addition to the current Prudential Standard CPS 234 Information Security (CPS 234), will strengthen trustees’ ability to swiftly respond in times of stress.

View APRA WebsiteAPRA and ASIC release notes on Superannuation CEO Roundtables

APRA and ASIC held Superannuation CEO Roundtables on Wednesday, 27... -

25 March 2024

APRA publishes Member Therese McCarthy Hockey’s remarks to COBA CEO and Director Forum

25 March 2024The Australian Prudential Regulation Authority (APRA) has published remarks delivered by Member Therese McCarthy Hockey to the Customer Owned Banking Association CEO and Director Forum in Sydney.

In her opening remarks ahead of taking questions, Ms McCarthy Hockey outlined the steps APRA is taking to minimise regulatory burden and enhance the proportionality of its prudential framework while also ensuring banks are prepared to respond to risks.

Her comments included:

- “At a time when the global financial system is evolving rapidly, the array of risks banks need to identify and manage is growing in both scope and severity. This time last year, we saw a banking crisis in the United States emerge and spread internationally with unprecedented speed, facilitated by social media and online banking.”

- “Enhancing the proportionality of the framework isn’t the only way we’ve sought to reduce the regulatory burden. As part of our corporate planning process in 2021, we also set about looking at our prudential rule book and considering whether it remained fit for purpose.”

- “We will continue to evolve our approach and prudential framework in response to new risks and changes in the operating environment. Your challenge as mutual banks is much the same: to understand the risks to your businesses from factors such as new rivals, technological innovation and evolving consumer preferences – and make sure you are equipped to respond.”

APRA publishes Member Therese McCarthy Hockey’s remarks to COBA CEO and Director Forum

The Australian Prudential Regulation Authority (APRA) has published remarks delivered... -

21 March 2024

Keynote speech by ASIC Chair Joe Longo at the Australian Institute of Company Directors (AICD) Australian Governance Summit

21 March 2024- Complying with directors’ duties may be difficult, but ASIC expects you to do it, it can be done, and there are benefits.

- Developments in AI, cyber threats, sustainable finance and ESG mean greater complexity in the business environment.

- Directors need to ask themselves the right questions: Are you acting honestly? Are you putting the company first? Do you have a continuous curiosity to understand the business and associated risks? And are you challenging management and getting professional advice?

Complying with directors’ duties may be difficult, but ASIC expects... -

14 March 2024

APRA and ASIC release a cross-industry information package on the Financial Accountability Regime

14 March 2024The Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC) have published further information to help banks, insurers and superannuation trustees prepare for the commencement of the Financial Accountability Regime (FAR).

The FAR, which takes effect for banks from 15 March 2024 and one year later for the insurance and superannuation industries, imposes a strengthened responsibility and accountability framework to improve the risk governance cultures of APRA-regulated entities, their directors and most senior executives.

View APRA WebsiteAPRA and ASIC release a cross-industry information package on the Financial Accountability Regime

The Australian Prudential Regulation Authority (APRA) and the Australian Securities...