Cyber security

What is Cyber security?

Cyber attacks are increasing, and every business needs to take action to manage cyber security. While your organisation will implement certain risk management strategies, every person has a part to play in protecting the information of your business and your customers.

It’s important that you understand the risks your organisation faces and what you can do to help protect organisational data.

Did you know? In 2014, the finance sector experienced 300 per cent more cyber attacks than other sectors.

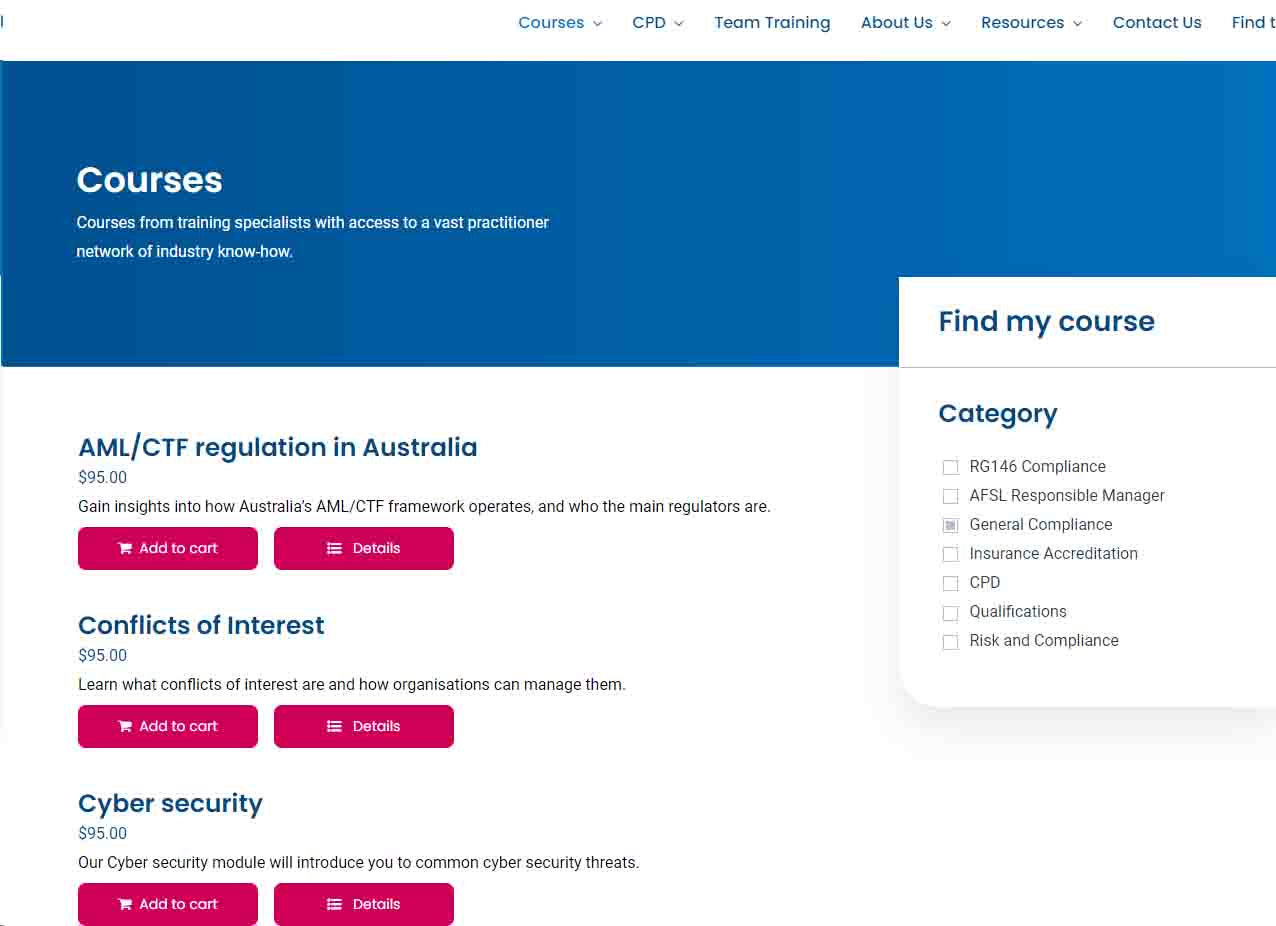

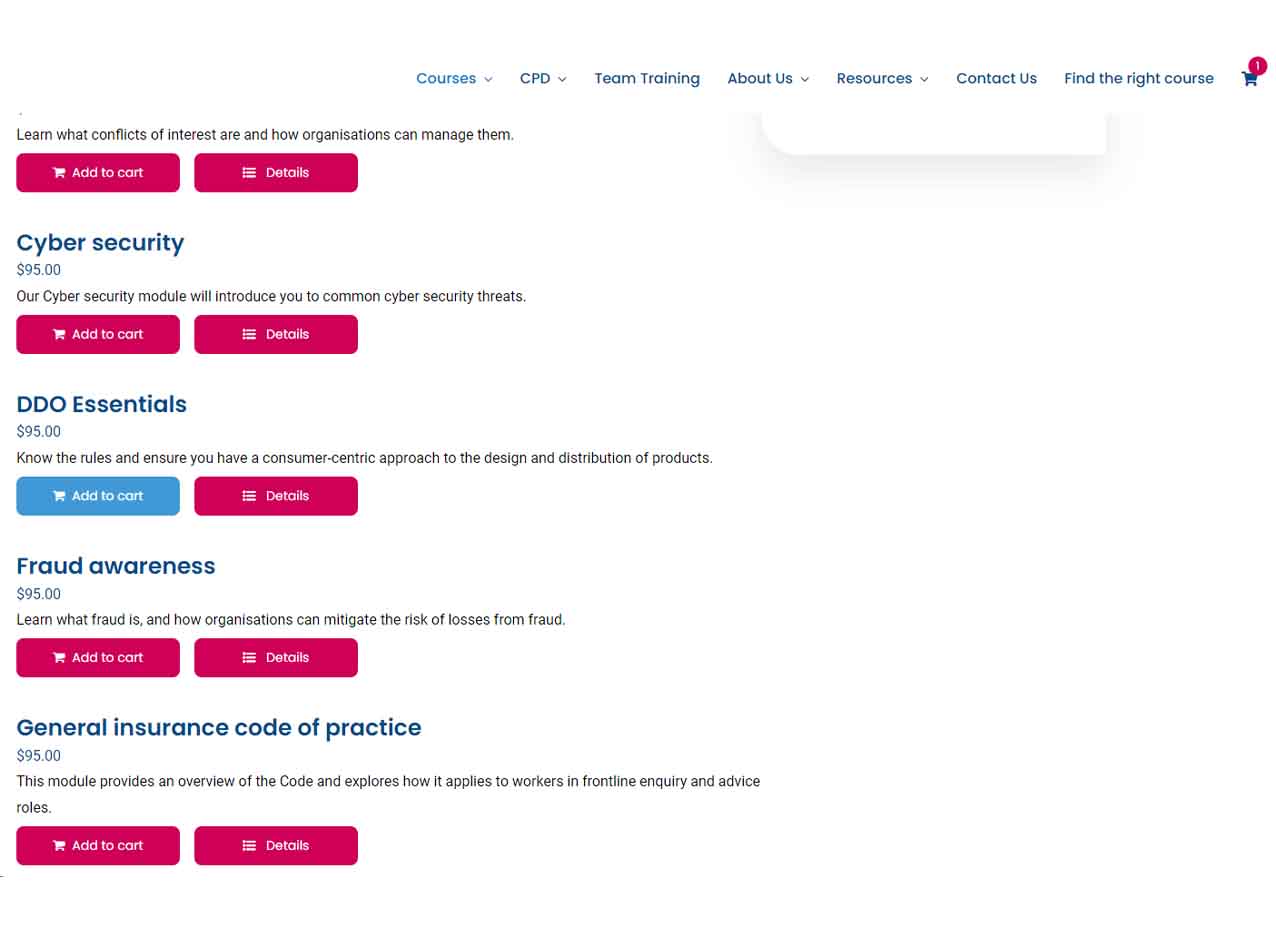

About our cyber security module

Our cyber security module is part of our regulatory compliance and conduct learning. Contextualised for Financial Services and whole of organisation training.

We introduce you to common cyber security threats, and what you can do to protect your organisation and customers from breaches.

The legislative landscape. Cyber security is subject to different types of legislation. These include:

- The Security of Critical Infrastructure Act 2018 (Cth) was amended in 2021 to require critical industries, including financial services, to report of cyber security incidents to the government.

- The Privacy Act (1988) (Cth) asks business to only collect and store information that is necessary for the business relationship.

- The Cybercrime Act 2001 (Cth) defines specific computer offences relating to cyber crime.

- The Spam Act 2003 (Cth), which prohibits the sending of unsolicited commercial email and electronic messages.

- The Telecommunications (Interception & Access) Act 1979 (Cth) makes it an offence for a person to access or intercept a private telecommunication.

Program Content

- What are cyber security threats?

- What you can do to manage cyber security

- Identifying and responding to phishing emails

- Identifying and responding to malware attacks

Learning Outcomes

- Define what cyber security is and discuss key risks for financial services organisations

- Describe the government and regulatory advice that financial services organisations need to consider

- Identify what you and your organisation can do to protect your business and customers.

What you will learn

Who is this course for?

- Any financial representatives who must be trained to adhere to financial services-specific regulation and industry codes with respect to conduct.

Units of Competency