Supporting vulnerable customers in consumer credit

Overview Supporting vulnerable customers in consumer credit

The financial services industry has a responsibility to take extra care with customers who experience vulnerability. This is outlined in the National Consumer Credit Protection Act 2009 (Cth) (NCCP Act), which describes the requirements for Responsible Lending Conduct.

A vulnerable consumer is defined as: “Somebody who, due to their personal circumstances, is especially susceptible to harm, particularly when a firm is not acting with appropriate levels of care”.

A person’s vulnerability may be due to a range of factors such as:

- Age

- Disability

- Mental health conditions

- Physical health conditions

- Family violence

- Language barriers

- Literacy barriers

- Cultural background

- Aboriginal or Torres Strait Islander status

- Remote location

- Financial distress.

The needs of vulnerable customers have become a priority in recent years, due to some cases identified by ASIC, in which providers had taken advantage of customers who did not have the ability to acquire or understand information about their financial situation.

About our Supporting vulnerable customers in consumer credit module

Our Supporting vulnerable customers in consumer credit module is part of our regulatory compliance and conduct learning. Contextualised for Financial Services and whole of organisation training.

In this module, you’ll learn some of the key drivers of vulnerability, and how you can identify people who might need additional support.

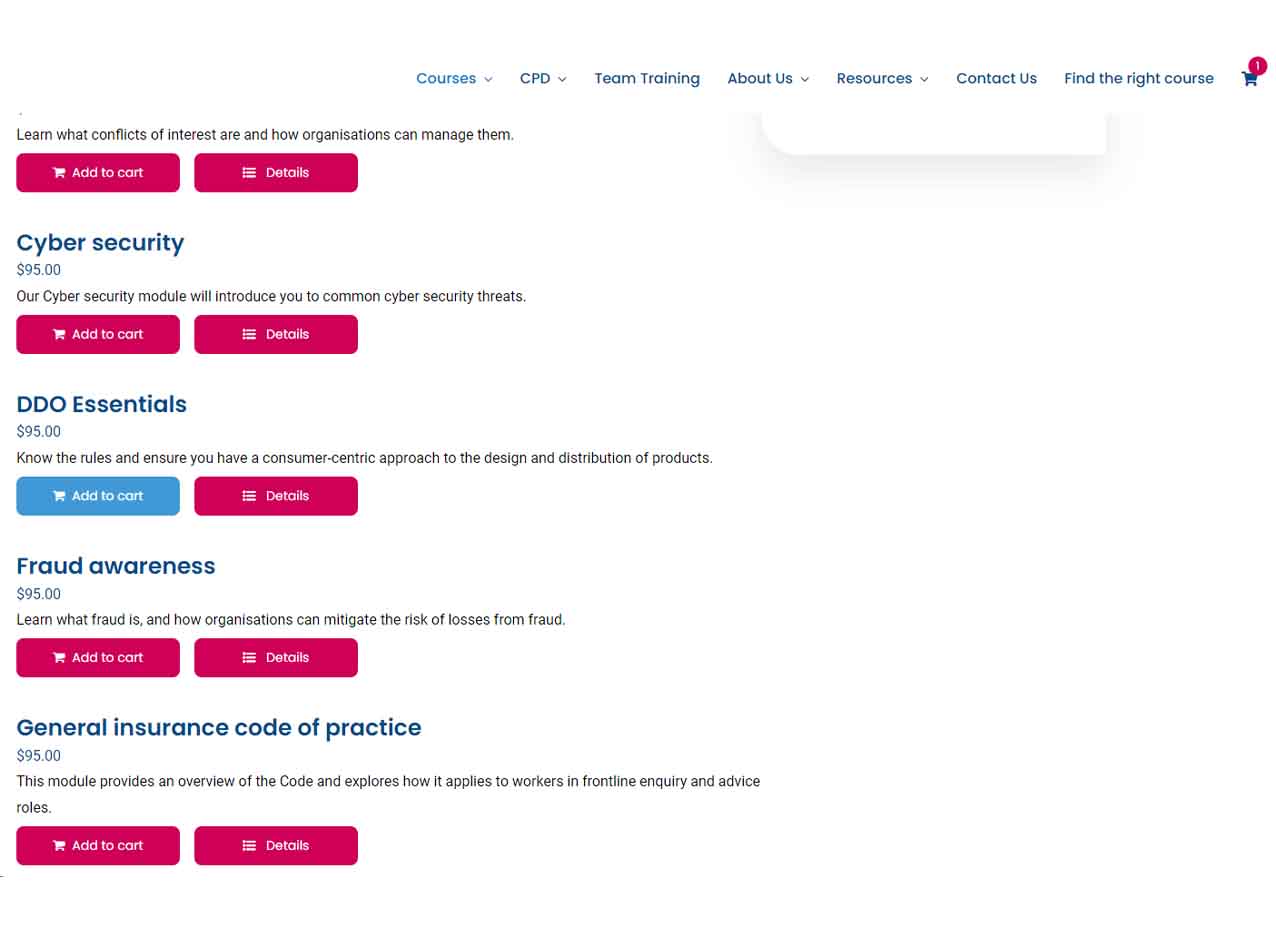

Program Content

- Your role in supporting vulnerable customers

- Recognising vulnerability

- Responding to your customers’ needs

Learning Outcomes

- Identify vulnerable customers

- Outline the obligations your organisation and you have under consumer credit laws and industry codes

- Describe ways you can support vulnerable customers

- Identify the additional support services that vulnerable customers can be referred to.

What you will learn

Who is this course for?

- Any financial representatives who must be trained to adhere to financial services-specific regulation and industry codes with respect to conduct.

Units of Competency