General Corporate Compliance Training

General Corporate Compliance

A simple enterprise-wide solution for a complex world of regulation.

Effective compliance training is learning that is engaging, relevant and meaningful for organisations and their employees.

Our Corporate Compliance modules are suitable for organisation wide training from front-line employees to management and leadership and directors.

- Licensees must comply with general obligations under various Acts, including the Corporations Act.

- All financial representatives must be trained to adhere to financial services-specific regulation and industry codes with respect to conduct.

Licensees are also required to be able to provide evidence to regulators that their representatives are adequately trained to perform their role on both an initial and ongoing basis.

(RG 104 AFS licensing: Meeting the general obligations, RG 205 Credit licensing: General conduct obligations).

Tailor your learning journey

Select specific modules your team requires allowing you to focus on just the areas that matter most.

Effective, meaningful training

Engaging modules, helping learners to efficiently process, retain, and apply information.

Flexible delivery

Online via our LMS or SCORM files hosted on your LMS. Customisable to your organisation’s policies and procedures.

Fits easily into busy workdays

Each module is 30-45 mins. The perfect study duration, balancing convenience with learning.

National consumer credit protection

Frequently Asked Questions

Corporate Solutions

Request a quote for your team.

OR

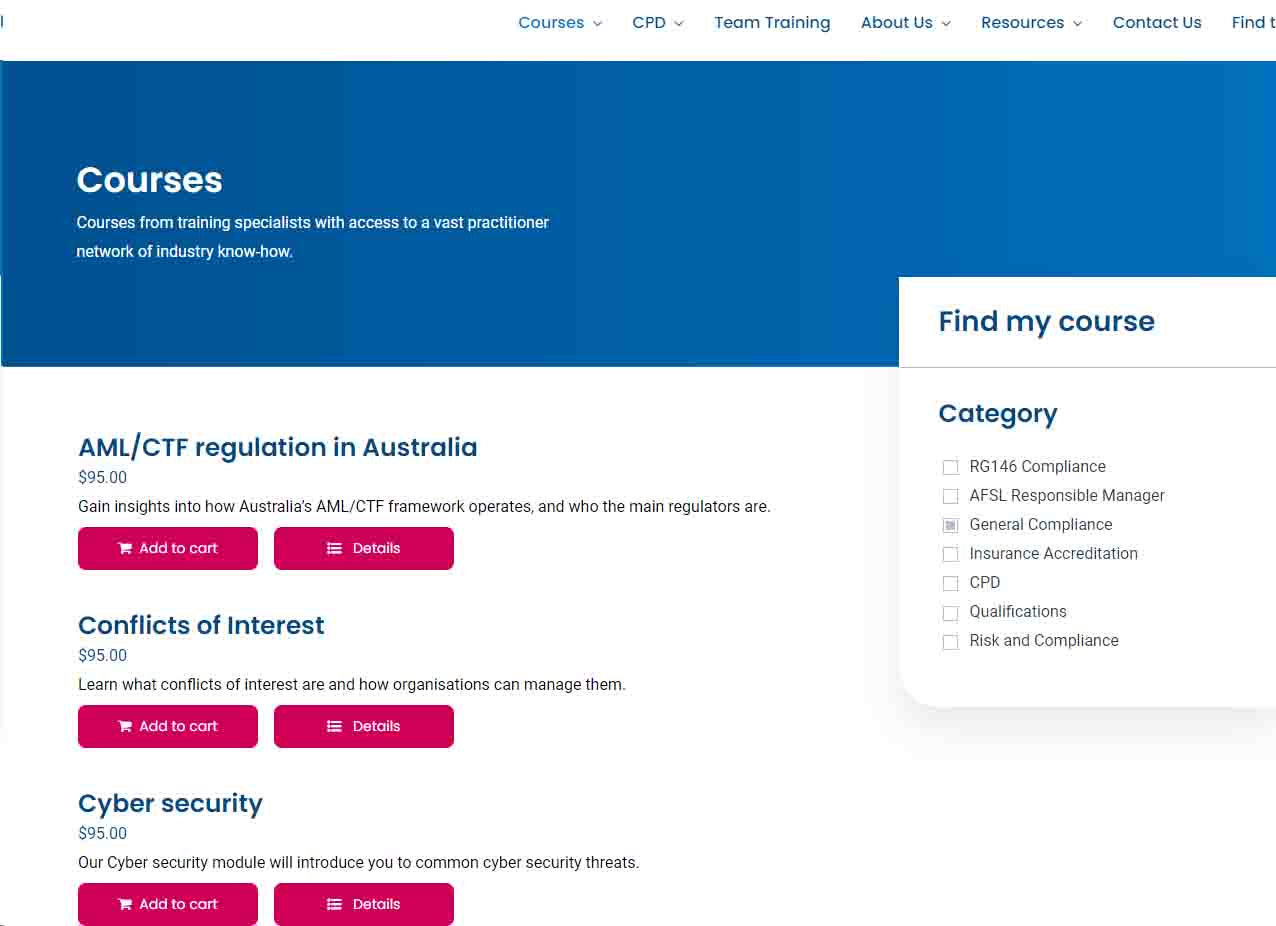

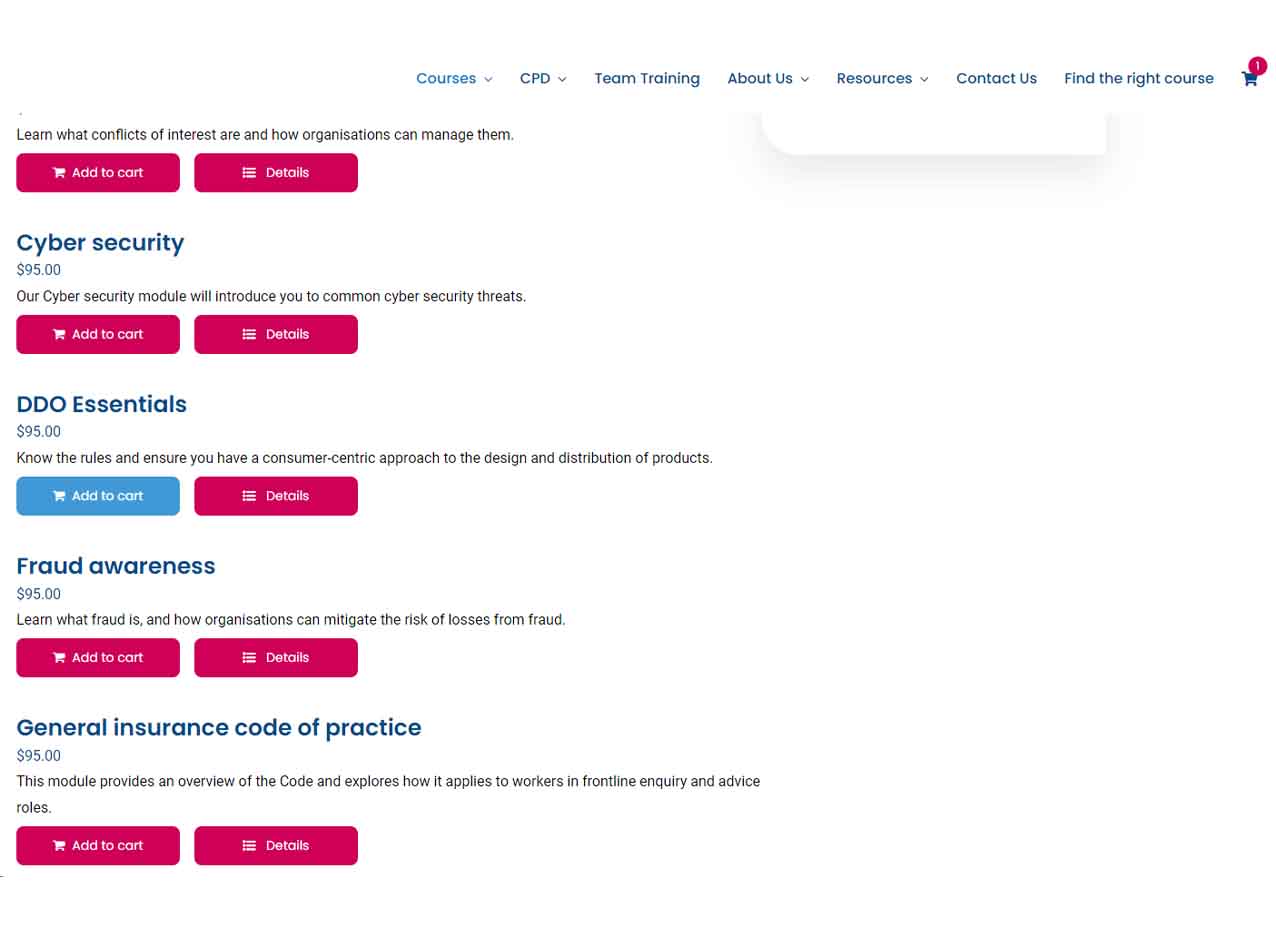

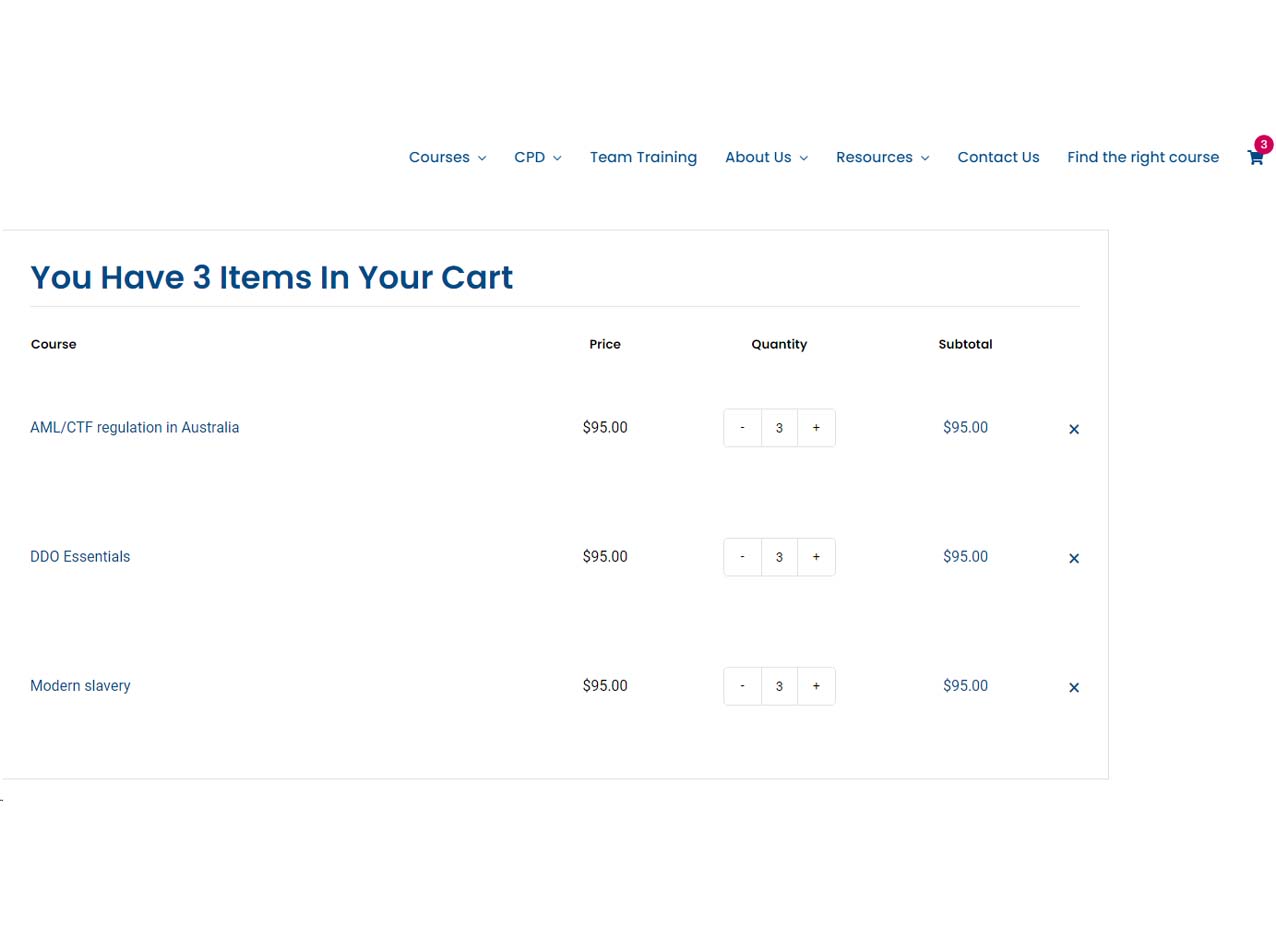

Purchase online: Three easy steps to get your team started.

- Visit our Shop Page and select General Compliance

- Select your courses to meet you and your team’s general obligations

- Add the required number of courses to your cart

We will request participants name and email. Once confirmed, we will enrol your team and they can begin their training.

Our general corporate compliance training contains a suite of engaging online modules designed to make employees aware of their responsibilities and feel empowered to uphold the conduct and regulatory standards applicable to their organisation.

A general compliance module – refers to a corporate e-learning course designed to meet specified organisational, legislative and/or conduct requirements.

The team at FEP understands that effective compliance training is not just about delivering regulatory content; it’s about creating learning that is engaging, relevant and impactful for organisations and their employees.

We design training experiences that resonate with individuals, ensuring they gain practical knowledge and skills that are immediately applicable to their roles.

Regulatory News

-

30 January 2025

ASIC acts to protect small business – Q2 FY25 update

30 January 2025Small businesses employ approximately half of the private sector workforce and contribute more than $500 billion to the Australian economy each year. They are essential for Australia’s prosperity.

ASIC assists small businesses by providing the information they need to operate lawfully, and by taking enforcement action against directors or companies when the law has been contravened.

In the period 1 October to 31 December 2024 enforcement action was taken by ASIC against:

- four company directors through disqualification – two for the maximum five years

- one director charged for making misleading statements to ASIC

- one director sentenced for making false statements to ASIC, and

- 58 individuals for 107 offences in failing to assist registered liquidators following the collapse of their companies.

ASIC acts to protect small business – Q2 FY25 update

Small businesses employ approximately half of the private sector workforce... -

30 January 2025

ASIC calls out superannuation trustees for weak scam and fraud practices

30 January 2025ASIC has written to superannuation trustees urging them to strengthen anti-scam practices, or risk exposing members to harm.

The open letter, signed by ASIC Commissioner Simone Constant, outlines our guidance for superannuation trustees in preventing, detecting and responding to scams and fraud activity.

Superannuation trustees have a key role to play in minimising the risk of scam and fraud risks to members, given they are the custodians of the second largest asset for many Australians.

View ASIC WebsiteASIC calls out superannuation trustees for weak scam and fraud practices

ASIC has written to superannuation trustees urging them to strengthen... -

30 January 2025

APRA publishes Deputy Chair Margaret Cole’s remarks to the Conexus Chair Forum

30 January 2025The Australian Prudential Regulation Authority has published remarks delivered by Deputy Chair Margaret Cole to the Conexus Chair Forum.

In her remarks, Ms Cole discusses the importance of strong board governance in super in areas including fund expenditure, investment and operational risk management. Ms Cole also flags APRA’s upcoming engagement with all APRA-regulated industries on a review to update core prudential governance standards.

Her comments included:

- “Funds with robust governance put themselves in a much stronger position to develop effective strategies and respond to challenges. Challenges include reputational risk.”

- “Take the politics out of this. This is a system to be proud of. That pride can’t be allowed to foster complacency or a blind eye to practices that have no place in today’s financial services giants. APRA is not attacking any particular board model but we do take issue with some practices. And frankly so should you.”

- “As Chairs you set the tone from the top in your organisations. You oversee the creation of policy and processes around expenditure. You have oversight of how your businesses are run, including how the executive spend and invest members’ money. Decisions made here have direct implications for members. Your role is critical.”

APRA publishes Deputy Chair Margaret Cole’s remarks to the Conexus Chair Forum

The Australian Prudential Regulation Authority has published remarks delivered by... -

16 January 2025

ASIC appoints Scott Gregson as CEO

16 January 2025ASIC has appointed Scott Gregson as Chief Executive Officer.

Mr Gregson will join ASIC on 17 March 2025 following a nearly 30 year career with the ACCC and takes over from ASIC’s retiring interim CEO Greg Yanco.

ASIC Chair Joe Longo said Mr Gregson had stood out in an executive search of domestic and international candidates.

‘Scott is an impressive leader and will bring extensive experience to this important role at ASIC,’ Mr Longo said.

‘His commitment to achieving regulatory outcomes that benefit all Australians makes him a strong addition to support ASIC’s commission and head the agency’s executive leadership team.’

View ASIC WebsiteASIC appoints Scott Gregson as CEO

ASIC has appointed Scott Gregson as Chief Executive Officer. Mr... -

13 January 2025

APRA grants new foreign ADI licence to Land Bank of Taiwan

13 January 2025The Australian Prudential Regulation Authority (APRA) has granted Land Bank of Taiwan Co., Ltd a licence to operate as a foreign authorised deposit-taking institution (Foreign-ADI) under the Banking Act 1959.

An updated list of all APRA-authorised ADIs can be found on the APRA website at: Register of authorised deposit-taking institutions.

View APRA WebsiteAPRA grants new foreign ADI licence to Land Bank of Taiwan

The Australian Prudential Regulation Authority (APRA) has granted Land Bank... -

5 December 2024

ASIC puts insurers on notice for blind spots in complaints handling

5 December 2024Insurers are failing to identify one in six customer complaints, effectively denying those Australians critical protections available through the Internal Dispute Resolution (IDR) regime, an ASIC review has found.

ASIC’s review of the IDR practices of 11 general insurers highlighted shortcomings in several areas, including the failure to identify complaints and systemic issues, as well as inadequate communications to customers.

ASIC’s analysis of insurance complaints handling comes as the volume of general insurance complaints made to the Australian Financial Complaints Authority (AFCA) swelled by 50% in the 2022-23 financial year, and rose again in 2023-24.

ASIC Commissioner Alan Kirkland said, ‘Consumers have a right to expect that their complaints will be identified and handled in a fair, timely and effective manner. When things go wrong, the complaints process provides an opportunity to get them back on track.

‘When insurers fail to identify complaints, they risk prolonging the distress of customers, especially those dealing with extreme events like floods. This failure denies customers access to important protections, including the right to escalate a complaint to AFCA for independent review.’

View ASIC WebsiteASIC puts insurers on notice for blind spots in complaints handling

Insurers are failing to identify one in six customer complaints,... -

4 December 2024

CP 381 Updates to INFO 225: Digital assets: Financial products and services

4 December 2024This consultation paper is about ASIC’s guidance on digital assets and related products.

It sets out our proposals to update Information Sheet 225 Crypto-assets (INFO 225) to provide further guidance about our interpretation of how the Corporations Act 2001 applies to crypto- and digital assets. It also sets out our proposals for licensing entities that provide financial services in relation to crypto- and digital assets that are financial products.

Released 4 December 2024. Comments close 28 February 2025.

View ASIC WebsiteCP 381 Updates to INFO 225: Digital assets: Financial products and services

This consultation paper is about ASIC’s guidance on digital assets... -

4 December 2024

Ensuring access to quality and affordable financial advice

4 December 2024The government announced updates to the Delivering Better Financial Outcomes reforms after consulting widely. These changes aim to:

- expand advice services

- reduce unnecessary compliance

- help advisers focus on high‑quality advice

- maintain strong consumer protections.

First tranche of reforms

View Treasury Website

The Treasury Laws Amendment (Delivering Better Financial Outcomes and Other Measures) Act 2024 simplifies rules that add costs without benefiting consumers. It became law on 9 July 2024.Ensuring access to quality and affordable financial advice

The government announced updates to the Delivering Better Financial Outcomes... -

29 November 2024

Privacy and Other Legislation Amendment Bill 2024

29 November 2024Amends the: Privacy Act 1988 and 7 other Acts to introduce a range of measures to protect the privacy of individuals with respect to their personal information, including expanding the Information Commissioner’s powers, facilitating information sharing in emergency situations or following eligible data breaches, requiring the development of a Children’s Online Privacy Code, providing protections for overseas disclosures of personal information, introducing new civil penalties, and increasing transparency about automated decisions which use personal information; Privacy Act 1988 to introduce a statutory tort to provide redress for serious invasions of privacy; and Criminal Code Act 1995 to introduce criminal offences targeting the release of personal data using a carriage service in a manner that would be menacing or harassing (known as ‘doxxing’).

View sourcePrivacy and Other Legislation Amendment Bill 2024

Amends the: Privacy Act 1988 and 7 other Acts to introduce a... -

29 November 2024

Anti-Money Laundering and Counter-Terrorism Financing Amendment Bill 2024

29 November 2024Amends the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 to: extend the anti-money laundering and counter-terrorism financing (AML/CTF) regime to additional services that are recognised by the Financial Action Task Force as posing high money laundering and terrorism financing risks; reframe and clarify the AML/CTF program and customer due diligence obligations; enable the Australian Transaction Reports and Analysis Centre to require the disclosure of information and conduct examinations; and update the AML/CTF regime to reflect changing business structures, technologies and illicit financing methodologies; and make consequential amendments. Also makes consequential or contingent amendments to 10 other Acts; and repeals the Financial Transaction Reports Act 1988.

View sourceAnti-Money Laundering and Counter-Terrorism Financing Amendment Bill 2024

Amends the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 to: extend the... -

27 November 2024

APRA and ASIC release observations from the banking industry’s implementation of the Financial Accountability Regime

27 November 2024The Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC) have published a letter containing observations on registration and notification lodgements made since the Financial Accountability Regime (FAR) commenced for the banking industry.

The letter identifies areas that require further consideration by banking entities and reiterates specific aspects, consistent with previously released FAR guidance, to entities across the banking, insurance and superannuation industries.

Entities should review the observations and areas for further consideration provided in the letter for the purposes of ensuring compliance with their obligations under the FAR.

View APRA WebsiteThe Australian Prudential Regulation Authority (APRA) and the Australian Securities and... -

25 November 2024

ASIC update on maintenance of regulatory guides

25 November 2024ASIC is updating its regulatory guides (RGs) to ensure they remain simple to follow, effective, current, and appropriate.

This is part of our firm commitment to improving regulatory efficiency and reducing regulatory complexity, as announced at this year’s ASIC Annual Forum.

To assist regulated entities in understanding the law, we publish updated regulatory guidance on an ongoing basis and this work will continue in 2025.

In 2025, ASIC will consult with stakeholders to update some key RGs, taking into account law reform, insights from case law about the provisions and other relevant issues. The RGs that we intend to update next year, include:

- Regulatory Guide 53 The use of past performance in promotional material

- Regulatory Guide 168 Disclosure: Product Disclosure Statements (and other disclosure obligations)

- Regulatory Guide 181 Licensing: Managing conflicts of interest

- Regulatory Guide 183 Approval of financial services codes of conduct, and

- Regulatory Guide 234 Advertising financial products and services (including credit): Good practice guidance.

ASIC update on maintenance of regulatory guides

ASIC is updating its regulatory guides (RGs) to ensure they... -

25 November 2024

APRA publishes Chair John Lonsdale’s speech on geopolitical risk

25 November 2024The Australian Prudential Regulation Authority (APRA) has published a speech delivered by Chair John Lonsdale this afternoon to the European Australian Business Council in Sydney.

In “Forewarned and forearmed”, Mr Lonsdale spoke about how financial regulators globally, including APRA, are increasing their focus on the potential for geopolitical events to impact the financial and operational soundness of banks, insurers and superannuation funds.

View APRA WebsiteAPRA publishes Chair John Lonsdale’s speech on geopolitical risk

The Australian Prudential Regulation Authority (APRA) has published a speech... -

20 November 2024

ASIC writes to superannuation trustees to drive improvement to death benefit claims handling

20 November 2024ASIC has been enforcing its expectations in relation to licensees’ treatment of customers experiencing vulnerability. Its communication to superannuation trustees to drive improvements to their death benefit claims handling practices followed its recent filing of civil penalty proceedings against Cbus.

View ASIC WebsiteASIC writes to superannuation trustees to drive improvement to death benefit claims handling

ASIC has been enforcing its expectations in relation to licensees’... -

20 November 2024

End-to-end accountability: Remarks to Association of Superannuation Funds of Australia Conference 2024

20 November 2024Banking, insurance, and superannuation entities are all encouraged to review the observations in the appendix to the letter, with ASIC Commissioner Simone Constant having reminded ASFA conference delegates that senior executives in the superannuation sector will become accountable persons under FAR from March 2025.

View ASIC WebsiteBanking, insurance, and superannuation entities are all encouraged to review... -

14 November 2024

ASIC Annual Forum 2024: Bridging generations – regulating for all Australians

14 November 2024Keynote opening address by ASIC Chair Joe Longo at the ASIC Annual Forum, 14 November 2024

Key points

- As a community, we rightly value regulation as a necessary part of our lives to advance and protect the interests of everyone, particularly the vulnerable.

- Against this background of multiple waves of reform, past present and future, and as we stand on the cusp of ever more change – it’s time for a renewed national discussion about regulatory complexity.

- It’s time to ask: is this working, and if not, what should be done? It means looking to the future and considering how things should evolve to deal with not just the problems of this generation – but also the next. That challenge is front of mind for ASIC.

ASIC Annual Forum 2024: Bridging generations – regulating for all Australians

Keynote opening address by ASIC Chair Joe Longo at the... -

14 November 2024

ASIC announces new enforcement priorities with a focus on cost of living pressures

14 November 2024In 2025, ASIC’s enforcement priorities will focus on:

- Misconduct exploiting superannuation savings

- Unscrupulous property investment schemes

- Failures by insurers to deal fairly and in good faith with customers

- Strengthening investigation and prosecution of insider trading

- Business models designed to avoid consumer credit protections

- Misconduct impacting small businesses and their creditors

- Debt management and collection misconduct

- Licensee failures to have adequate cyber-security protections

- Greenwashing and misleading conduct involving ESG claims

- Member services failures in the superannuation sector

- Auditor misconduct

- Used car finance sold to vulnerable consumers by finance providers

ASIC announces new enforcement priorities with a focus on cost of living pressures

In 2025, ASIC’s enforcement priorities will focus on: Misconduct exploiting... -

12 November 2024

ASIC sues Cbus alleging systemic claims handling failures

12 November 2024ASIC Deputy Chair Sarah Court said, ‘Delays in claims processing like those alleged by ASIC cause real harm to families who may be relying on the payments to meet critical expenses. This adds to difficult personal circumstances, whether grieving for a loved one or dealing with severe injury or illness. The additional anxiety and pain these delays caused compounded the issues these members and their families faced.”

ASIC sues Cbus alleging systemic claims handling failures

ASIC Deputy Chair Sarah Court said, ‘Delays in claims processing... -

12 November 2024

What happened at ASIC’s first Digital Assets Liaison Meeting

12 November 2024ASIC’s inaugural Digital Assets Liaison Meeting (DALM) took place on 11 September 2024. More than 190 industry representatives attended online and in person at ASIC offices.

The DALM has been established as a regular event to provide the digital assets industry with insights into ASIC’s strategic priorities and key projects, and give opportunity for Q&A.

View ASIC WebsiteWhat happened at ASIC’s first Digital Assets Liaison Meeting

ASIC’s inaugural Digital Assets Liaison Meeting (DALM) took place on... -

24 October 2024

APRA amends operational risk financial requirements for superannuation trustees

24 October 2024The Australian Prudential Regulation Authority (APRA) has amended the prudential requirements for superannuation trustees relating to operational risk financial requirements (ORFR) as set out in Prudential Standard SPS 114 Operational Risk Financial Requirement (SPS 114) and related guidance.

The changes aim to strengthen operational resilience by ensuring trustees can better access the financial resources held to meet the ORFR when needed and to maintain an appropriate level of reserving.

The key changes are to:

- clarify the purpose of the ORFR;

- widen the allowable range of uses for the ORFR;

- introduce a clear and direct relationship with Prudential Standard CPS 230 Operational Risk Management (CPS 230); and

- amend the APRA notification requirements to facilitate further use of the ORFR.

APRA amends operational risk financial requirements for superannuation trustees

The Australian Prudential Regulation Authority (APRA) has amended the prudential...